Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the RegistrantþFiled by a Party other than the Registranto| SCHEDULE 14A INFORMATION |

| Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

| Filed by the Registrant [X] |

| Filed by a Party other than the Registrant [ ] |

|

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement | [ ] | Confidential, for Use of Commission |

| [X] | Definitive Proxy Statement | | Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Additional Materials | | | |

| [ ] | Soliciting Material Pursuant to par 240.14a-11(c) or par. 240.14a-12 |

| | | | | | |

Check the appropriate box:MidSouth Bancorp, Inc. |

| (Name of Registrant as Specified In Its Charter) | |

| | | | | | |

oBoard of Directors of MidSouth Bancorp, Inc. |

| Preliminary(Name of Person(s) Filing Proxy Statement, | | o | | Confidential, for Use of Commission | | if other than the Registrant) |

þ

| | Definitive Proxy Statement | | | | | | Only (as permitted by Rule 14a-6(e)(2)) | | |

o

| | Definitive Additional Materials | | | | | | | | |

o | | Soliciting Material Pursuant to par 240.14a-11(c) or par. 240.14a-12Payment of Filing Fee (Check the appropriate box): |

MidSouth Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

Board of Directors of MidSouth Bancorp, Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | |

o | [ ] | $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or item 22(a)(2) of Schedule 14A. |

| | | | | | |

o | [ ] | $500 per each party to the controversy pursuant to Exchange Act Rule 14a-6(i)(3). |

| | | | | | |

o | [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | | | | | |

| | 1 | ) | | 1) | Title of each class of securities to which transaction applies: |

| | | | | | | |

| | 2 | ) | | 2) | Aggregate number of securities to which transaction applies: |

| | | | | | | |

| | 3 | ) | | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | | | |

| | 4 | ) | | 4) | Proposed maximum aggregate value of transaction: |

| | | | | | | |

| | 55) | )Total Fee Paid: | | | Total Fee Paid: |

| | | | | | |

| | | | | |

o | [ ] | Fee paid previously with preliminary materials. |

| | | | | | | |

o | [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | | | |

| | 11) | )Amount Previously Paid: | | | Amount Previously Paid: |

| | | | | | | |

| | 2 | ) | | 2) | Form, Schedule or Registration Statement No.: |

| | | | | | | |

| | 3 | ) | | 3) | Filing Party: |

| | | | | | | |

| | 44) | )Date Filed: | | | Date Filed: |

| | | | | |

102 Versailles Boulevard

Versailles Centre

Lafayette, Louisiana 70501

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Lafayette, Louisiana

We will hold our annual shareholders meeting of shareholders of MidSouth Bancorp, Inc. (“MidSouth”) will be held on Thursday,Wednesday, May 26, 2005,28, 2008, at 4:2:00 p.m., local time, at our corporate offices, 102 Versailles Blvd., Lafayette, Louisiana 70501, where we will vote upon:

1. The MCM Eleganté, at 2355 I-10 South, Beaumont, Texas, 77705 to elect directors and to consider suchelection of directors.

2. Such other matters as may properly come before the meeting or any

adjournments thereof.Only holdersadjournments.

If you are listed on our books as the holder of record of MidSouthour common stock at the close of business on March 2831,2005, 2008, you are entitled to notice of and to vote at the meeting.

Your vote is important regardless of the number of shares you own. WHETHER OR NOT YOU PLAN TO ATTENDCOME TO THE MEETING,PLEASE MARK, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ACCOMPANYING ENVELOPE. YOUR PROXY MAY BE REVOKED BY APPROPRIATE NOTICE TO MIDSOUTH’SOUR SECRETARY AT ANY TIME PRIOR TOBEFORE IT IS VOTED.

BY ORDER OF THE VOTING THEREOF.BOARD

| | | | |

| | BY ORDER OF THE BOARD

OF DIRECTORS | | |

| | | | |

| | Karen L. Hail

Secretary | | |

Karen L. Hail

Secretary

102 Versailles Boulevard

Versailles Centre

Lafayette, Louisiana 70501

This Proxy Statement is furnished holders of common stock of MidSouth Bancorp, Inc. (“MidSouth”) in connection with the solicitationbeing sent to our stockholders to solicit on behalf of itsour Board of Directors (the “Board”) of proxies for use at MidSouth’sour annual shareholders meeting (the “Meeting”) to be held on Thursday,Wednesday, May 26, 2005,28, 2008, at the time and place shown in the accompanying notice and at any adjournments thereof. This Proxy Statement is first being mailed to shareholders on or about April 2523, 2005. 2008.

Only holders of

record of MidSouthour common stock

(“Common Stock”("stock")

on our books at the close of business on March

28, 2005,31, 2008, are entitled to notice of and to vote at the Meeting. On that date

MidSouthwe had outstanding

4,487,1356,762,531 shares of

Common Stock.stock, each of which is entitled to one vote.

The presence, in person or by proxy, of

holders of a majority of

the outstanding shares of Commonour Stock

entitledis needed to

vote is necessary to constitutemake up a

quorum. Ifquorum; if a quorum is present, directors are elected by

plurality vote; withplurality. With respect to any other proposal,

that may properly come before the Meeting,however, if the Board has recommended it by

the affirmative vote of thea majority of

theour Continuing Directors, as defined in

MidSouth’sour Articles of Incorporation,

(“Articles”), then, generally, the

affirmative vote of a majority of the votes cast is required to approve it,

butand if it is not so recommended, then the

affirmative vote of 80% of the Total Voting Power, as defined in the Articles, is required to approve it.

MidSouth’s By-laws provide that theThe Continuing Directors will appoint the Judge(s) of Election, and

that all questions as to

thevoter qualification,

of voters,proxy validity

of proxies and

the acceptanceaccepting or

rejection ofrejecting votes will be decided by the Judge(s).

Abstentions or broker non-votes will

not have

noany effect on the election of directors.

With respect toOn any other proposal, abstentions and broker non-votes will be counted as votes not cast and will have no effect on any proposal

requiringthat needs a majority of votes cast to approve it and will have the effect of a vote against any proposal

requiring an affirmativethat needs the vote of a percentage of the Total Voting Power.

All proxies received in the

enclosed form

enclosed will be voted as

specifiedyou specify and,

in the absence of instructionsunless you specify to the contrary, will be voted for the election of the persons named herein.

MidSouth doesWe do not know of

any mattersanything else to be presented at the Meeting other than

those described herein; however,the election, but if

any other matters properlyanything else does come

before the Meeting or any adjournments thereof, it is the intention ofup the persons named in the enclosed proxy

towill vote the shares

representedcovered by

them in accordance with their best judgment. The enclosedthe proxy as determined by the Board of Directors.

A proxy may be revoked by

the shareholderyou at any time

prior tobefore its exercise by filing with

MidSouth’sour Secretary a written revocation or a duly executed proxy

bearingwith a later date.

A shareholder who votesIf you vote in person in a manner inconsistent with a proxy previously filed

on his or her behalfby you, you will be deemed to have revoked the proxy as to the matters

you voted

uponon in person.

- 2 -

The cost of soliciting proxies in the enclosed form will be borne by MidSouth.us. In addition to the use of the mail, proxies may be solicited by personal interview, telephone, telegraph, facsimile, internet and e-mail. Banks, brokerage houses and other nominees or fiduciaries may be requestedasked to forward the soliciting materialthese materials to their principals and to obtain authorization for the execution ofget authority to execute proxies, and MidSouthwe will, upon request, reimburse them for their expenses in so acting.

ELECTION OF DIRECTORS

The

Our Articles provide for three classes of directors, with one class to be elected at each annual meeting for a three-year term. At the Meeting, Class III Directors will be elected to serve until the

third succeeding2011 annual

meeting and until their successors have been duly elected and qualified.meeting.

Unless

you withhold authority,

is withheld, the persons named in the enclosed proxy will vote the shares

representedcovered by the proxies received by them for the election of the

threefour Class III director nominees named below.

In the unanticipated event thatIf for some reason we do not anticipate one or more nominees cannot be a candidate at the Meeting, the shares

represented will be voted in favor of such other

nomineespersons as

may be designated by the

Board.Board chooses. Directors will be elected by plurality vote.

Other than the Board, only shareholders entitled to vote for the election of directors who have complied with the procedures of Article IV(H)IV (H) of MidSouth’sour Articles may nominate a person for election. To do so, the shareholderyou must have given us written notice to MidSouth by December 6, 2004,27, 2007, of the following:

(1) as to each person whom he or she proposesyou propose to nominate, nominate:

(a) his or her name, age, business address, residentialresidence address, principal occupation or employment, and

(b) the class and number of shares of MidSouth’sour stock of which he or shethe person is the beneficial owner and (b)

(c) any other information relating to suchthe person that would be required to be disclosed in solicitations of proxies for the election of directors by Regulation 14A under the Securities Exchange Act of 1934; and

(2) as to the shareholder giving the notice, you:

(a) his or heryour name and address and

(b) the class and number of shares of stock of MidSouthour Stock of which he or she isyou are the beneficial owner and (b)

(c) a description of any agreements, arrangements or relationships between the shareholderyou and each person he or she proposesyou want to nominate.

Two inspectors, not affiliated with

MidSouth,us, appointed by

MidSouth’sour Secretary, will determine whether the notice provisions were met; if they determine that

the shareholder hasyou have not complied with Article IV(H),

the defectiveyour nomination will be disregarded.

- 3 -

The following table

sets forth certaingives information as of March

21, 2005, with respect to31, 2008, about each director nominee and each

director whose term as a director will continue after the Meeting.other director. Unless otherwise indicated, each person has

been engaged inhad the principal occupation shown for at least the past five years. The Board recommends a vote FOR each of the

three nominees named

below.Directortherein.

Directors Nominees for terms expire in 2011 (Class III Directors)

| | | | | Year First Became Director |

| James R. Davis, Jr. | | | 55 | | President, Davis/Wade Financial Services, L.L.C.; Chairman of our Audit Committee and our Lead Director | 1991 |

| Karen L. Hail | | | 54 | | Our Senior Executive Vice President and Chief Operating Officer of our subsidiary MidSouth Bank, N.A. | 1988 |

| Milton B. Kidd, III, O.D. | | | 59 | | Optometrist, Kidd Vision Centers, Kidd and Associates, L.L.C. | 1996 |

| R. Glenn Pumpelly | | | 49 | | President/ C.E.O. Pumpelly Oil Company, L.L.C. | 2007 |

| | | | | | | |

Directors whose terms to expire in 20082009 (Class IIII Directors)

| | | | | | | | | | | |

| | | | | | | | | Year First |

| Name | | Age | | Principal Occupation | | Became Director |

| James R. Davis, Jr. | | | 52 | | | Owner/President, Davis-Wade Financial Services, L.L.C.; Chairman, MidSouth Audit Committee (Lead Director) | | | 1991 | |

| | | | | | | | | | | |

| Karen L. Hail | | | 51 | | | Senior Executive Vice President/Chief Operations Officer, MidSouth Bancorp and MidSouth Bank, N.A. (the “Bank”), MidSouth’s wholly-owned subsidiary | | | 1988 | |

| | | | | | | | | | | |

| Milton B. Kidd, III, O.D. | | | 56 | | | Optometrist, Kidd & Associates, L.L.C. | | | 1996 | |

Directors | | | | | Year First Became Director |

| C.R. Cloutier | | | 61 | | Our President and C.E.O., and President of our subsidiary, MidSouth Bank, N.A. | 1984 |

| J.B. Hargroder, M.D. | | | 77 | | Physician, retired; Vice Chairman of our Board | 1984 |

| Timothy J. Lemoine | | | 57 | | Consultant and Investor | 2007 |

| William M. Simmons | | | 74 | | Investor | 1984 |

| | | | | | | |

Director whose terms

to expire in

2006 (Class I Directors)| | | | | | | | | | | |

| | | | | | | | | Year First |

| Name | | Age | | Principal Occupation | | Became Director |

| C. R. Cloutier | | | 57 | | | President and C.E.O., MidSouth and the Bank | | | 1984 | |

| | | | | | | | | | | |

| J. B. Hargroder, M.D. | | | 74 | | | Physician, retired; Vice Chairman, MidSouth Board | | | 1984 | |

| | | | | | | | | | | |

| Ron D. Reed | | | 51 | | | President and C.E.O., Lamar Bank, MidSouth’s wholly-owned subsidiary | | | 2004 | |

| | | | | | | | | | | |

| William M. Simmons | | | 71 | | | Private Investments | | | 1984 | |

Directors whose terms expire in 20072010 (Class II Directors)

| | | | | | Year First Became Director |

| Will Charbonnet, Sr. | | | | 60 | | Our Chairman of the Board; Treasurer and Managing Director of Crossroads Catholic Bookstore (non-profit corporation); Controller of Philadelphia Fresh Foods, L.L.C. | 1984 |

| Clayton Paul Hilliard | | | | 82 | | President of Badger Oil Corporation, Badger Oil & Gas Ltd., Convexx Oil and Gas, Inc., and Warlord Oil Corporation; Manager, Uniqard, L.L.C. | 1984 |

| Joseph V. Tortorice, Jr. | | | | 58 | | CEO, Deli Management, Inc. | 2004 |

| | | | | | | | | | | | | | | |

| | | Year First | | | | | | |

| Name | | Age | | Principal Occupation | | Became Director | |

| Will G. Charbonnet, Sr. | | | 57 | | | Chairman of the Board, MidSouth and the Bank; Treasurer, Lafayette Catholic Book Store; Computer/Business Consultant (1986-Present); Director Lafayette Catholic Social Services (non-profit charity) | | | 1984 | | |

| | | | | | | | | | | | |

| Clayton Paul Hilliard | | | 79 | | | President/Owner: Badger Oil Corporation, Badger Oil & Gas Ltd., Convexx Oil and Gas, Inc., Warlord Oil Corporation | | | 1985 | | |

- 4 -

| | | | | | | | | | | |

| | | | | | | | | Year First |

| Name | | Age | | Principal Occupation | | Became Director |

| Stephen C. May | | | 56 | | | Publisher and principal shareholder MayDay Communications, L.L.C.-The Independent Weekly; Investor and business consultant (1999-Present) | | | 2000 | |

| | | | | | | | | | | |

| Joseph V. Tortorice, Jr. | | | 56 | | | President, Deli Management, Inc.; Chairman of the Board, Lamar Bank, MidSouth’s wholly-owned subsidiary | | | 2004 | |

Shareholder, Board of Director and Committee Meetings.During 2004,2007 the Board held fifteen meetings. Each incumbenthad twelve meetings, and each director attended at least 75% of the aggregatetotal number of meetings held during 2004 of the Board and committees of which he or she was a member. While the Company encourageswe encourage all Board members of the Board to attendcome to annual shareholder meetings, there is no formal policy as to their attendance. It is a rare occasion, however, when all members of the Board are not present for the shareholder meeting. At the annual meeting of May 18, 2004, all directors were in attendance.there.

Board of Director Independence.Each year, theour Corporate Governance and Nominating Committee reviews the relationships that each director has with the Companyus and with other parties. Only those directors who do not have any relationships that precludekeep them from being independent within the meaning of applicable American Stock Exchange (“AMEX”) rules and who the Corporate Governance and Nominating Committee affirmatively determinesfinds have no relationships that would interfere with the exercise of independent judgment in carrying out thetheir responsibilities of a director are considered to be “independent directors.” The Corporate Governance and Nominating Committee has reviewedreviews a number of factors to evaluate the independence, of each board member. These factors includeincluding the directors’ relationships with the Companyus and itsour competitors, suppliers and customers; their relationships with management and other directors; the relationships their current and former employers have with the Company;us; and the relationships between the Companyus and other companies of which the membersthey are directors or executive officers. After evaluating these factors, the Board has determined that Messrs. Charbonnet, Davis, Hargroder, Hilliard, Kidd, May,Lemoine, Pumpelly, Simmons Tortorice and WeirTortorice are independent directors within the meaning of applicable AMEX rules.

Shareholder Communications.Shareholders may communicate directly with members of the Board or the individual chairmanchairmen of standing committees by writing directly to those individualsthem at the following address: P. O. Box 3745, Lafayette, LA 70502. The Company’s policy is toWe will forward, and not to intentionally screen, any mail received at the Company’s corporate officewe receive that is directed to an individual, unless the Company believeswe believe the communication may pose a security risk.

Code of Ethics.The Board has adopted a Code of Ethics for our directors, officers and employees of the corporation. It is intended to promote honest and ethical conduct, full and accurate reporting, and compliance with laws as well as other matters. A copy of the Code- 5 -

of Ethics is posted on the Corporate Relations page of the Company’sour website atwww.midsouthbank.com.

www.midsouthbank.com.

The Board has an Audit Committee, an Executive Committee, a Personnel Committee, and a Corporate Governance and Nominating Committee.

The

members of the Audit Committee

members are Messrs. Davis, Charbonnet, Hilliard, and

Kidd. The Committee, whichKidd and held nine meetings in

2004,2007. It is responsible for carrying out the Audit Committee

Charter which is attached to the Proxy Statement as Exhibit B.Charter. The members of the Executive Committee members members are Messrs. Charbonnet, Cloutier, Hargroder, Pumpelly, and Hargroder. The Committee’sTortorice and met eleven times in 2007. Its duties include shareholder relations, Bank examination and Securities and Exchange Commission (“SEC”) reporting. The Committee met thirteen times in 2004.

The members of the Personnel Committee members are Messrs. Charbonnet, Davis, Hargroder, Hilliard, Kidd, May and Simmons. The Committee, whichTortorice and met foursix times in 2004,2007. It is responsible for evaluating the performance and settingsetting/approving the compensation of MidSouth’sour executive officers and administering MidSouth’s Stockour 2007 Omnibus Incentive Compensation Plan.

The members of the Corporate Governance and Nominating Committee members are Messrs. Charbonnet, Hargroder, Hilliard and Hilliard. The Committee assistsSimmons and met three times in 2007. It helps the Board in makingto make determinations of director independence, assessingassess overall and individual Board performance and recommendingrecommend director candidates, including those recommendations submitted by shareholders. The Committee met once in 2004.

Although

It is the Corporate Governance and Nominating Committee does not have a formal charter, it does operate under Corporate Governance Principles that are attached to this proxy statement, and it is the Committee’s policy that candidates for director possesshave the highest personal and professional integrity, have demonstrated exceptional ability and judgment, and have skills and expertise appropriate for the Company and serving the long-term interest of the Company’sour shareholders. The Committee’s process for identifying and evaluating nominees is as follows: (1) in the case of incumbent directors whose terms of office are set to expire, the Committee reviews such directors’their overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance, and any related party transactions with the Companyus during the applicable time period; and (2) in the case of new director candidates, the Committee first conducts any appropriate and necessary inquiries into thetheir backgrounds and qualifications of possible candidatesare made after considering the function and needs of the Board. The Committee meets to discuss and consider such candidates’ qualification,qualifications, including whether the nominee is independent within the meaning of AMEX rules, and then selects a candidate for recommendation to the Board by majority vote.Board. In seeking potential nominees, the Corporate Governance and Nominating Committee uses its and management’s network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. Tofirm, although to date the Committeeit has not paid a fee to any third party to assist in the process of identifying or evaluating director candidates.- 6 -

done so.

The Corporate Governance and Nominating Committee will consider director candidates recommended by shareholders provided the shareholderswho follow the procedures set forthout in Article IV(H)IV (H) of the Company’s Articles. The committeeour Articles described elsewhere. It does not intend to alter the manner in which it evaluates candidates, including the criteria set forth above, based on whether the candidate was recommended by a shareholder or otherwise.

Eligible shareholders who desirewant to present a proposal qualified for inclusion in theour proxy materials relating tofor the 20062009 annual meeting must forward such proposal to theour Secretary of MidSouth at the address listed on the first page of this Proxy Statement in time to arrive at MidSouth before December 13, 2005. The Board has adopted a Statement of Corporate Governance Principles, a copy of which is attached as Exhibit A to this proxy statement.

A majority of the directors of MidSouth are also directors of the Bank. Directors are entitled to fees of $100 per month for service on the MidSouth Board and $200 per month for service on the Bank Board. The Chairman of the Board receives an additional $750 per month, the Vice Chairman receives an additional $350 per month and the Chairman of the Audit Committee receives an additional $670 per month. Each director also receives $350 for each regular meeting, and $125 for each special meeting of the Board of the Bank, and $150 for the first hour, and $75 per hour for each additional hour, of each committee meeting. Directors receive meeting fees only for meetings they attend.

In 1997 directors who were not employees were granted options to purchase up to 15,081 shares of Common Stock at $4.85 per share, the fair market value on the date of grant, exercisable in annual 20% increments beginning one year from the date of grant. Stephen C. May, a more recent addition to the Board, was granted options in 2002 to purchase up to 8,938 shares of Common Stock at $9.46 per share, the fair market value on the date of grant, exerciseable in annual 20% increments beginning one year from the date of grant.

25, 2008.

The Securities and Exchange Act of 1934 and applicable SEC regulations require MidSouth’sour directors, executive officers and ten percent shareholders to file with the SEC initial reports of ownership and reports of changes in ownership of our equity securities, of MidSouth, and to furnish MidSouthus with copies of all the reports they file. To MidSouth’sour knowledge, based on a review of reports furnished to MidSouth,given us, all required reports were filed timely.- 7 -

___________________

SECURITY OWNERSHIP OF MANAGEMENT

AND CERTAIN BENEFICIAL OWNERS

Security Ownership of Management

The following table sets forth certain informationshows as of March 21, 2005, concerning31, 2008, the beneficial ownership of Commonour Stock by each director and nominee, of MidSouth, by each executive officer named in the Summary of Executive Compensation Table below, and by all directors and executive officers as a group. Unless otherwise indicated, the securities areStock is held with sole voting and investment power.

| | | | | | | | | |

| | | Amount and Nature | | | | |

| | | of Beneficial | | | Percent | |

| Name | | Ownership(1) | | | of Class | |

| | | | | | | | | |

| Will G. Charbonnet, Sr. | | | 125,819 | (1,2) | | | 2.79 | % |

| | | | | | | | | |

| C. R. Cloutier | | | 285,703 | (1,3) | | | 6.29 | % |

| | | | | | | | | |

| James R. Davis, Jr. | | | 63,632 | (4) | | | 1.41 | % |

| | | | | | | | | |

| Karen L. Hail | | | 103,898 | (5) | | | 2.30 | % |

| | | | | | | | | |

| J. B. Hargroder, M.D. | | | 355,879 | (1,6) | | | 7.91 | % |

| | | | | | | | | |

| Clayton Paul Hilliard | | | 170,781 | (7) | | | 3.79 | % |

| | | | | | | | | |

| Milton B. Kidd, III, O.D. | | | 165,538 | (8) | | | 3.68 | % |

| | | | | | | | | |

| Stephen C. May | | | 103,575 | (9) | | | 2.31 | % |

| | | | | | | | | |

| Ron D. Reed | | | 7,262 | | | | .16 | % |

| | | | | | | | | |

| William M. Simmons | | | 147,245 | (10) | | | 3.27 | % |

| | | | | | | | | |

| Joseph V. Tortorice, Jr. | | | 50,827 | | | | 1.13 | % |

| | | | | | | | | |

| Lonnie C. Weir | | | 7,791 | | | | .17 | % |

| | | | | | | | | |

| Jennifer S. Fontenot | | | 23,699 | (11) | | | .53 | % |

| | | | | | | | | |

| Donald R. Landry | | | 78,157 | (12) | | | 1.73 | % |

| | | | | | | | | |

| A. Dwight Utz | | | 7,977 | (13) | | | .18 | % |

| | | | | | | | | |

| All directors and | | | 1,728,960 | | | | 36.92 | % |

| executive officers as a group (18 persons) | | | | | | | | |

| | Amount and Nature of Beneficial Ownership(1) | | | | |

| Will G. Charbonnet, Sr. | | | 161,345 | (1,2) | | | 2.39 | % |

| C. R. Cloutier | | | 404,278 | (1,3) | | | 5.96 | % |

| James R. Davis, Jr. | | | 75,365 | (4) | | | 1.11 | % |

| Karen L. Hail | | | 106,255 | (5) | | | 1.57 | % |

| J. B. Hargroder, M.D. | | | 457,502 | (1,6) | | | 6.77 | % |

| Clayton Paul Hilliard | | | 250,987 | (7) | | | 3.71 | % |

| Milton B. Kidd, III, O.D. | | | 241,942 | | | | 3.58 | % |

| Timothy J. Lemoine | | | 24,875 | (8) | | | .37 | % |

| R. Glenn Pumpelly | | | 15,779 | | | | .23 | % |

| William M. Simmons | | | 215,211 | (9) | | | 3.18 | % |

| Joseph V. Tortorice, Jr. | | | 86,607 | | | | 1.28 | % |

| J. Eustis Corrigan, Jr. | | | 9,871 | (10) | | | .15 | % |

| Donald R. Landry | | | 106,068 | (11) | | | 1.57 | % |

| A. Dwight Utz | | | 16,586 | (12) | | | .24 | % |

| All directors and executive officers as a group (17 persons) | | | 2,222,111 | | | | 32.64 | % |

_______________

| (1) | | Common Stock held by MidSouth’s Directors’our Directors' Deferred Compensation Trust (the “Trust”) is beneficially owned by its Plan Administrator, MidSouth’sour Executive Committee, the members of which could be deemed to share beneficial ownership with respect toof all Common Stock held in the Trust (230,818(347,361 shares or 5.14% as of March 21, 2005)31, 2008). For each director, the table includes |

- 8 -

| | the number of shares held for his or her account only, while the group figure includes all shares held in the Trust at March 21, 2005. CommonTrust. Stock held by MidSouth’sour Employee Ownership Plan (the “ESOP”) is not included in the table, except that shares allocated to an individual’sindividual's account are included as beneficially owned by that individual. Shares which may be acquired by exercise of currently exercisable options (“Current Options”) are deemed outstanding for purposes of computing the percentage of outstanding Common Stock owned by persons beneficially owning such shares and by all directors and executive officers as a group but are not otherwise deemed to be outstanding. |

|

| (2) | | Includes 31,25347,826 shares as to which he shares voting and investment power, 33,132 shares held for his account in the Trust and 15,081 shares, which he may acquire within 60 days pursuant to currently exercisable stock options (“Current Options”).power. |

|

| (3) | | Includes 35,647 shares held by the ESOP for his account, 103,629227,927 shares as to which he shares voting and investment power, 40,343 shares held for his account in the Trust, and 53,436 shares under Current Options.power. Mr. Cloutier’sCloutier's address is P. O. Box 3745, Lafayette, Louisiana 70502. |

|

| (4) | | Includes 8,4028,998 shares as to which he shares voting and investment power, 26,201 shares held for his account in the Trust and 15,081 shares under Current Options.power. |

|

| (5) | | Includes 34,806 shares held for her account in the ESOP, 8661,244 shares as to which she shares voting and investment power, 25,874 shares held for her account in the Trust and 34,239 shares under Current Options.power. |

|

| (6) | | Includes 308,923404,477 shares as to which he shares voting and investment power, 35,625 shares held for his account in the Trust, and 11,331 shares under Current Options.power. Dr. Hargroder’sHargroder's address is P. O. Box 1049, Jennings, Louisiana 70546. |

|

| (7) | | Includes 107,252131,303 shares as to which he shares voting and investment power, 15,073 shares held for his account in the Trust and 15,081 shares under Current Options.power. |

|

| (8) | | Includes 11,892 shares held for his account in the Trust and 7,581 shares under Current Options. |

|

(9) | | Includes 3,575 shares under Current Options. |

|

(10) | | Includes 4,22120,539 shares as to which he shares voting and investment power, 34,151 shares held for his account in the Trust, and 11,331 shares under Current Options.power. |

|

(11) | (9) | Includes 17,223 shares held for her account in the ESOP and 6,476 shares under Current Options. |

|

(12) | | Includes 34,5066,092 shares as to which he shares voting and investment power, 16,151 shares held for his account in the ESOP and 10,098 shares under Current Options.power. |

|

(13) | (10) | Includes 2,2555,719 shares as to which he shares voting and investment power, 922power. |

| (11) | Includes 51,468 shares held for his account in the ESOPas to which he shares voting and 4,800investment power. |

| (12) | Includes 1,555 shares under Current Options.as to which he shares voting and investment power. |

_______________________

- 9 -

The following table shows the number of shares in the Trust and ESOP, and the number of shares subject to Current Options, that have been included in the above Ownership Table.

| | | | | | | | | |

| Will G. Charbonnet, Sr. | | | 49,307 | | | | -- | | | | -- | |

| C. R. Cloutier | | | 60,040 | | | | 40,238 | | | | 24,816 | |

| James R. Davis, Jr. | | | 38,994 | | | | -- | | | | -- | |

| Karen L. Hail | | | 38,507 | | | | 53,477 | | | | -- | |

| J. B. Hargroder, M.D. | | | 53,025 | | | | -- | | | | -- | |

| Clayton Paul Hilliard | | | 22,425 | | | | -- | | | | -- | |

| Milton B. Kidd, III, O.D. | | | 17,687 | | | | -- | | | | -- | |

| Timothy J. Lemoine | | | 4,336 | | | | -- | | | | -- | |

| R. Glenn Pumpelly | | | -- | | | | -- | | | | -- | |

| William M. Simmons | | | 50,826 | | | | -- | | | | -- | |

| Joseph V. Tortorice, Jr. | | | 622 | | | | -- | | | | -- | |

| J. Eustis Corrigan, Jr. | | | -- | | | | -- | | | | 19,688 | |

| Donald R. Landry | | | -- | | | | 25,507 | | | | -- | |

| A. Dwight Utz | | | -- | | | | 2,399 | | | | 12,813 | |

Security Ownership of Certain Beneficial Owners

The following table sets forth certain informationlists as of March 21, 2005, concerning31, 2008, the only persons other than the persons listed in the table above known to MidSouthus to be the beneficial owner ofbeneficially own more than five percent of its Commonour Stock.

| | | | | | | |

| Name and Address | | Shares Beneficially | | Percent |

| Of Beneficial Owner | | Owned | | of Class |

| MidSouth Bancorp, Inc., Employee Stock Ownership Plan, ESOP Trustees and ESOP Administrative Committee P. O. Box 3745, Lafayette, LA 70502 | | 381,166(1) | | 8.49 % |

| | | | | | | |

MidSouth Bancorp, Inc.,(2) Directors Deferred Compensation Plan, Executive Committee P. O. Box 3745, Lafayette, LA 70502 | | | 230,818 | | | 5.14 % |

Name and Address of Beneficial Owner | | Shares Beneficially Owned | | | | |

MidSouth Bancorp, Inc., Employee Stock Ownership Plan, ESOP Trustees and ESOP Administrative Committee P. O. Box 3745, Lafayette, LA 70502 | | | 530,462 | (1) | | | 7.84 | % |

MidSouth Bancorp, Inc., (2) Directors Deferred Compensation Plan, Executive Committee P. O. Box 3745, Lafayette, LA 70502 | | | 347,361 | | | | 5.14 | % |

___________________

| (1) | | The Administrative Committee directs the Trustees how to vote the approximately 10,3754,966 unallocated shares of Common Stock in the ESOP as of March 21, 2005.31, 2008. Voting rights of the shares allocated to ESOP participants’participants' accounts are passed through to them. The Trustees have investment power with respect to the ESOP’sESOP's assets, but must exercise it in accordance with an investment policy established by the Administrative Committee. The Trustees are Donald R. Landry, an executive officer, of MidSouth, and Katherine Gardner and Brenda Jordan, two Bank employees. The Administrative Committee consists of employees Polly Leonard an employee,and Felicia Savoie and Teri S. Stelly, an executive officer of MidSouth, and Dailene Melancon, a Bank officer.Stelly. |

|

| (2) | | See Note (1) to the Table of Security Ownership of Management. |

_________________________

- 10 -

Certain Transactions

Directors, nominees and executive officers and their associates have been customers of, and have borrowed from, our bank subsidiaries in the ordinary course of business, and such transactions are expected to continue in the future. In the opinion of management, our loan policy is less favorable to those persons than to other customers.

C. R. Cloutier and his wife, Brenda Cloutier have pledged 15,000 shares of our Stock to Whitney Bank securing a loan in the amount of $284,000 for their daughter's daycare business. Additionally, Mr. and Mrs. Cloutier have pledged 6,979 shares of our Stock to First National Banker's Bank to secure a personal loan in the amount of $140,000.

James R. Davis has pledged 27,355 shares of our Stock to Capital One Investments to secure a $250,000 line of credit.

C. P. Hilliard has pledged 43,572 shares of our Stock to MidSouth Bank as partial security on a $1,000,000 line of credit with a balance outstanding of $296,423.

_________________________

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND

CERTAIN TRANSACTIONSSummary of Executive Compensation

ANALYSIS

The following table showsCompensation Discussion and Analysis may contain statements regarding future individual and company performance targets or goals. We have disclosed these targets or goals in the limited context of the Company’s compensation programs; and, therefore, you should not take these statements to be statements of management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply such statements to other contexts.

This Compensation Discussion and Analysis provides insight into the Company’s executive compensation programs. It explains the philosophy underlying our compensation strategy and the fundamental elements of compensation paid to our Chief Executive Officer, Chief Financial Officer, and other individuals included in the Summary Compensation Table (“Named Executive Officers”). Specifically, this Compensation Discussion and Analysis addresses the following:

| · | Objectives of our compensation programs; |

| · | What our compensation programs are designed to reward; |

| · | Elements of compensation provided to our executive officers; |

| | The purpose of each element of compensation |

| | Why we elect to pay each element of compensation |

| | How each element of compensation was determined by the Committee |

| | How each element and our decisions regarding its payment relate to our goals |

| · | Process for determining executive officer compensation; and |

| · | Other important compensation policies affecting our executive officers. |

During 2007, the Company began a restructuring process to meet the demands and changes of the business brought on by the rapid growth and increase in size of the Company. The restructuring process impacted the implementation of changes in Named Executive Officer compensation during 2007, as well as the allocation of various compensation elements to these employees during the past year. Throughout this document we highlight the specific impact of this process as we discuss the Company’s executive compensation elements and programs.

The Personnel Committee of the Board of Directors (“Committee”) administers our executive compensation programs. During 2007, the Committee consisted of Will Charbonnet, Sr. (Chairman), James R. Davis, Jr., J. B. Hargroder, M.D., and Joseph V. Tortorice, Jr. The members of the Committee all qualify as independent, outside members of the Board of Directors in accordance with the requirements of the American Stock Exchange (AMEX), current SEC regulations, and section 162(m) of the Internal Revenue Code.

Objectives of Our Compensation Programs

The Committee has the responsibility for continually monitoring the compensation awardedpaid to earnedour executive officers. The Committee believes that compensation of our executive officers should encourage creation of stockholder value and achievement of strategic corporate objectives. Specifically, the Committee ensures the total compensation package for our executive officers will serve to:

| · | Attract, retain, and motivate outstanding executive officers who add value to the Company based on individual and team contributions; |

| · | Provide a competitive salary structure in all markets where we operate; and |

| · | Align the executive officers’ interests with the long-term interests of our shareholders to incent them to enhance shareholder value. |

What Our Compensation Programs Are Designed to Reward

Our executive officers' compensation is designed to reward short term performance as well as long term performance. Our policy is to provide a large portion of compensation in cash, including an annual base salary, and an opportunity to receive an annual incentive that is based on basic earnings per share (EPS). We provide this to keep the executive officers focused on current earnings and stability and to strongly align the executives with the interests of our shareholders. We also view the annual incentive as a long term performance vehicle because we examine performance measures including credit quality, credit risk management, deposit growth, regulatory compliance, return on equity, and growth in our assets and income when assessing incentive grants to the executive officers. Credit quality, non accruals, and charge offs are impacted by long term performance such that performance in the current year affects these measures in future years.

Additionally, we have historically provided additional compensation benefits through our 1997 Stock Incentive Plan and our Employee Stock Ownership Plan (ESOP), which keeps the executive officers focused on our long term goals. On a going forward basis, we will continue with our ESOP and will be providing equity compensation through our shareholder approved 2007 Omnibus Incentive Plan.

Over the last several years, our performance has been above average as compared to similarly situated financial institutions, and the compensation programs are designed to reward and promote the continuation of this performance. We aim to provide a substantial portion of executive officers compensation in the form of performance based compensation through the annual incentive opportunity. Therefore, the increase in the executive officers compensation over the past few years is based on this exceptional performance.

Process for Determining Executive Officer Compensation

• Role of the Committee and the Executive Officers. The Committee along with the Board of Director’s oversight and approval will annually review and approve goals and objectives relating to compensation of the Chief Executive Officer. Based on this evaluation, the Committee recommends the Chief Executive Officer’s compensation level to the Board of Directors. The Committee also consults with the Chief Executive Officer on the compensation levels of the other executive officers. Based on these discussions, the Committee will recommend, along with the Chief Executive Officer, the other executive officers compensation levels to the Board of Directors.

Additionally, the Committee periodically reviews our incentive plans and other equity based plans. The Committee reviews, adopts, and submits to the Board of Directors any proposed arrangement or plan and any amendment to an existing arrangement or plan that provides or will provide benefits to the executive officers collectively or to an individual executive officer. The Committee has sole authority to retain and terminate a compensation consultant or other advisor as the Committee sees appropriate.

• Role of the Compensation Consultant. In making compensation decisions for 2007, the Committee did not have a contractual arrangement with a compensation consultant to advise in setting the amount or determining the form of compensation to the executive officers.

At the end of 2007, the Committee engaged Amalfi Consulting LLC (formerly the Compensation Practice of Clark Consulting) to conduct an overall compensation review of the Company’s top executive employees, including all of the five Named Executive Officers presented in this proxy. The results of the compensation review will be used on a going-forward basis in making compensation decisions related to the top executive employees of the Company.

In addition to the overall compensation review, Amalfi Consulting LLC assisted the Company with the creation of plan documents related to executive compensation programs and with the production of this proxy filing. Amalfi Consulting LLC reported directly to the Committee on all projects conducted and performed no other services for the Company in 2007.

• Benchmarking. To ensure the competitiveness of our total compensation package, the Committee uses salary survey information from several different nationally recognized surveys that focus on our industry and region. Specifically, the Company used salary survey information compiled by K G & Associates that included surveys from Watson Wyatt and Mercer. This information was used to evaluate how comparable institutions are paying their executive management. In 2007, K G & Associates conducted no other business with the Company. Along with the data compiled by K G & Associates, the Committee considered data from an additional compensation survey conducted by Scheshunoff Management Services.

In using survey data, we benchmark both base salary and annual incentive. Long term incentives are not benchmarked because we feel that long term incentives are not part of the basic compensation of the executive officers. Long term incentives are viewed as an additional opportunity for the executive officer based on the value of our stock price.

Based on our prior year earnings, the total cash compensation paid to the Named Executive Officers, for all services renderedwhich includes base salary and annual incentive, is approximately at the 75th percentile of compensation market levels as reported by themthe surveys.

As noted earlier, at the end of 2007 the Committee, in all capacitiescoordination with Amalfi Consulting LLC, conducted an overall review of the executive compensation program. As part of this review, a peer group of 20 banks comparable to MidSouth in terms of geographic location, asset size, growth and its subsidiariesperformance was selected. We present the peer group in the table below. Values reported in the table are as of year-end 2006.

Benchmarking Peer Group

| | | | | | Total Assets | Asset Growth | ROAA | ROAE |

| | | | | | 2006Y | 3 Yr | 2006Y | 2006Y |

| | Company Name | Ticker | City | State | ($000) | (%) | (%) | (%) |

| 1 | First M&F Corporation | FMFC | Kosciusko | MS | 1,540,275 | 42.8% | 0.94% | 11.4% |

| 2 | Great Florida Bank | GFLBA | Coral Gables | FL | 1,535,981 | NA | 0.57% | 3.7% |

| 3 | ViewPoint Financial Group (MHC) | VPFG | Plano | TX | 1,529,760 | 16.5% | 0.65% | 6.8% |

| 4 | Southern Community Financial Corporation | SCMF | Winston-Salem | NC | 1,436,465 | 79.8% | 0.31% | 3.1% |

| 5 | BancTrust Financial Group, Inc. | BTFG | Mobile | AL | 1,353,406 | 25.7% | 1.02% | 9.7% |

| 6 | Encore Bancshares, Inc. | EBTX | Houston | TX | 1,336,843 | 0.8% | 0.57% | 8.3% |

| 7 | TIB Financial Corp. | TIBB | Naples | FL | 1,319,093 | 97.1% | 0.76% | 11.4% |

| 8 | MetroCorp Bancshares, Inc. | MCBI | Houston | TX | 1,268,434 | 46.3% | 1.13% | 13.6% |

| 9 | CenterState Banks of Florida, Inc. | CSFL | Winter Haven | FL | 1,077,102 | 76.9% | 0.86% | 7.7% |

| 10 | Florida Community Banks, Inc. | FLCM | Immokalee | FL | 1,016,677 | 93.5% | 2.31% | 28.9% |

| 11 | Peoples Financial Corporation | PFBX | Biloxi | MS | 964,023 | 66.3% | 1.40% | 14.0% |

| 12 | Pulaski Financial Corp. | PULB | Saint Louis | MO | 962,460 | 139.8% | 1.14% | 15.0% |

| 13 | Peoples BancTrust Company, Inc. | PBTC | Selma | AL | 910,705 | 17.0% | 0.95% | 9.5% |

| 14 | Nexity Financial Corporation | NXTY | Birmingham | AL | 891,022 | 70.5% | 0.75% | 9.8% |

| 15 | Bank of Florida Corporation | BOFL | Naples | FL | 883,102 | 296.7% | 0.32% | 2.3% |

| 16 | First Federal Bancshares of Arkansas, Inc. | FFBH | Harrison | AR | 852,475 | 23.4% | 0.85% | 9.4% |

| 17 | Federal Trust Corporation | FDT | Sanford | FL | 722,964 | 54.4% | 0.46% | 6.7% |

| 18 | United Security Bancshares, Inc. | USBI | Thomasville | AL | 646,296 | 13.9% | 2.24% | 16.1% |

| 19 | Auburn National Bancorporation, Inc. | AUBN | Auburn | AL | 635,126 | 7.6% | 1.06% | 14.7% |

| 20 | Sun American Bancorp | SAMB | Boca Raton | FL | 503,883 | 435.5% | 0.97% | 5.1% |

| | Average | | | | 1,069,305 | 84.4% | 0.96% | 10.4% |

| | 50th Percentile | | | | 990,350 | 54.4% | 0.90% | 9.6% |

| | MidSouth Bancorp, Inc. | MSL | Lafayette | LA | 805,022 | 86.0% | 1.08% | 14.7% |

Although we did not use the data from this review to assess or change compensation programs for our Named Executive Officers during 2007, we plan to use the information from the review to make decisions on a going-forward basis for 2008.

Elements of Compensation

We have determined that it is our and our shareholders’ best interest to provide competitive compensation to attract and retain the most qualified executive officers with demonstrated leadership abilities that will secure our future. We do this by providing compensation that is tied to our short and long term performance goals to motivate our executive officers to attain these goals.

The performance goals that we examine may include credit quality, credit risk management, deposit growth, regulatory compliance, return on equity, and growth in our assets and income.

We have not made any material changes in individual compensation in 2007 compared to 2006. In addition, due to possible changes in roles and responsibilities as a result of the restructuring, adjustments to base salary salaries and other compensation elements have been postponed until 2008.

The elements of compensation used during 2007 to compensate the executive officers include:

| · | Health and Insurance Plans; |

| · | Long Term Equity Awards; and |

Below is a discussion of each element of compensation listed above, including the purpose of each element of compensation, why we elect to pay each element of compensation, how each element of compensation was determined by the Committee, and how each element and our decisions regarding the payment of each element relate to our goals.

• Base Salary. Although we favor the use of incentive compensation, we believe it is necessary and prudent to pay a portion of total compensation in the form of a competitive fixed base salary. We believe the payment of a fixed base salary to our executive officers helps maintain productivity by minimizing anxiety that a financial or industry slump could impair their personal and family planning.

It is our goal to set base salary to reflect the role and responsibility of the executive officer over time and to comfortably meet the executive’s needs. Base salary, although not directly connected to performance, is essential to compete for talent and our failure to pay a competitive base salary could harm our ability to recruit and retain management. Base salary was initially determined by analyzing base salaries of comparable executives in the marketplace and considering the abilities, qualifications, accomplishments, prior work experience, and cost of living of the executive officer.

When setting base salary levels, the Committee takes into account the total direct cash compensation amount targeted for each executive. Essentially, base salary is established by determining the amount of money in combination with the anticipated amount of annual incentive that was necessary to attract and retain top caliber executive officers.

Base salary adjustments are generally considered annually in December on a discretionary basis and take into account the executive officer’s individual performance over the prior year, changes in the executive officer’s responsibilities, our performance, and market levels of compensation.

In December of 2005 and 2006, the Committee recommended to the Board 2006 and 2007 base salary for the past three years. NoChief Executive Officer and in consultation with the Chief Executive Officer 2006 and 2007 base salary for the other executive officers except for Mr. Corrigan’s 2006 base salary. Mr. Corrigan was hired during 2006 and his base salary for 2006 was set by the Chief Executive Officer and approved by the Committee upon his hire date.

Base salary for 2006 and 2007 for each of the Named Executive Officers is as follows:

| | | 2006 Base Salary | | | 2007 Base Salary | | | % Increase | |

| C.R. Cloutier | | $ | 196,000 | | | $ | 200,000 | | | | 2.0 | % |

| J. Eustis Corrigan Jr. | | $ | 165,000 | | | $ | 175,000 | | | | 6.1 | % |

| Karen L. Hail | | $ | 149,595 | | | $ | 157,000 | | | | 5.0 | % |

| Donald R. Landry | | $ | 139,552 | | | $ | 147,000 | | | | 5.3 | % |

| A. Dwight Utz | | $ | 98,348 | | | $ | 112,000 | | | | 13.9 | % |

The 13.9% increase for Mr. Utz reflects both an increase in job responsibility occurring in 2007, and a market pay adjustment. The 6.1% increase for Mr. Corrigan is based upon terms of his employment agreement associated with his hire in 2006. Other increases reflect normal merit and market adjustments.

As noted earlier, due to the restructuring activities of the Company decisions on bases salary adjustment for 2008 have not been determined. Once base salary decisions have been made, the new salaries will be made effective retroactively to January 1, 2008.

• Annual Incentives. Annual incentives are provided to the executive officers through the Company’s Incentive Compensation Plan (CICP).

Company’s Incentive Compensation Plan (CICP)

Annual incentives are primarily designed to reward increased shareholder value as well as to focus the executive officers on our goals for a particular year and to reward executive officers upon achievement of those goals. We believe annual incentives are an important element of executive officers’ compensation because they provide the incentive and motivation to lead us in achieving success. The annual incentive under the CICP is tied to basic earnings per share (EPS) and makes up a very significant part of the executive officer’s compensation. If the executive officer is able to significantly improve our performance then the executive officer will have a significant increase in annual incentive for the year. If the performance is below expectations then the executive officer will have a reduction in compensation.

We use a system of MidSouth had total annual salaryincentives to reward the executive officers quarterly based on EPS. Before the beginning of each year, the Committee awards each executive officer a specified number of phantom shares of our stock. Annual incentive is determined quarterly equal to the number of phantom shares times our basic EPS for the quarter. Sixty percent of the amount determined is paid each quarter and bonus exceeding $100,000the balance is paid at the end of the year, provided we were profitable for the entire year. If we are not profitable for the year (i.e., the fourth quarter results in 2004.a large loss) then the balance that was held back will not be paid.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Long-Term Compensation | | | | |

| | | | | | | | | | | | | | | Other | | | | | | | | | | | | | |

| Name and | | | | | | | | | | | | | | Annual | | | Restricted | | | Securities | | | | | | | |

| Principal | | | | | | | | | | | | | | Compen- | | | Stock | | | Underlying | | | LTIP | | | All Other | |

| Position | | Year | | | Salary(1) | | | Bonus(2) | | | sation | | | Award(s) | | | Option(s) | | | Payouts | | | Compen-sation(3) | |

| C. R. Cloutier | | | 2004 | | | $ | 222,029 | | | $ | 92,516 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | $ | 8,892 | |

| President & Chief | | | 2003 | | | $ | 212,504 | | | $ | 76,680 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | $ | 8,895 | |

| Executive Officer | | | 2002 | | | $ | 204,275 | | | $ | 49,320 | | | | 0 | | | | 0 | | | | 12,500 | | | | 0 | | | $ | 8,678 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Karen L. Hail | | | 2004 | | | $ | 152,037 | | | $ | 55,509 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | $ | 6,962 | |

| Senior Exec VP & | | | 2003 | | | $ | 145,417 | | | $ | 46,008 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | $ | 6,598 | |

| Chief Oper. Off. | | | 2002 | | | $ | 139,283 | | | $ | 29,592 | | | | 0 | | | | 0 | | | | 6,000 | | | | 0 | | | $ | 5,619 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Donald R. Landry | | | 2004 | | | $ | 113,740 | | | $ | 43,945 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | $ | 6,657 | |

| Exec. VP & Chief | | | 2003 | | | $ | 110,063 | | | $ | 36,423 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | $ | 6,192 | |

| Lending Officer | | | 2002 | | | $ | 105,833 | | | $ | 23,427 | | | | 0 | | | | 0 | | | | 5,000 | | | | 0 | | | $ | 5,433 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| A. Dwight Utz | | | 2004 | | | $ | 92,000 | | | $ | 30,068 | | | | 0 | | | | 0 | | | | 500 | | | | 0 | | | $ | 4,232 | |

| Senior VP & Retail | | | 2003 | | | $ | 92,000 | | | $ | 22,543 | | | | 0 | | | | 0 | | | | 1,000 | | | | 0 | | | $ | 4,071 | |

| Executive Manager | | | 2002 | | | $ | 92,000 | | | $ | 11,813 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | $ | 1,734 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jennifer Fontenot | | | 2004 | | | $ | 78,500 | | | $ | 31,442 | | | | 0 | | | | 0 | | | | 500 | | | | 0 | | | $ | 3,812 | |

| Senior VP/Chief | | | 2003 | | | $ | 75,000 | | | $ | 20,136 | | | | 0 | | | | 0 | | | | 1,000 | | | | 0 | | | $ | 1,622 | |

| Info. Officer | | | 2002 | | | $ | 74,673 | | | $ | 12,330 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | $ | 490 | |

(1) | | Includes director fees of $26,350 and $25,750 for 2004, $24,550 and $24,325 for 2003, and $25,925 and $24,950 for 2002 for Mr. Cloutier and Ms. Hail, respectively. |

|

(2) | | Awarded pursuant to the Incentive Compensation Plan of the Bank. |

|

(3) | | Consists of $7,108, $6,303, $5,885, $4,232 and $3,812 contributed by MidSouth to the ESOP for the accounts of each of Mr. Cloutier, Ms. Hail, Mr. Landry, Mr. Utz, and Ms. Fontenot, respectively; and $1,784, $659 and $772 paid by MidSouth in insurance premiums for term life insurance for the benefit of Mr. Cloutier, Ms. Hail and Mr. Landry, respectively. |

_____________________

- 11 -

Option Holdings

The following table sets forth information with respectnumber of phantom shares granted each year is generally considered in December on a discretionary basis and takes into account the executive officer’s individual performance compared to the prior year, his or her importance to us, and our overall financial performance. The granting of phantom shares as the annual incentive in lieu of awarding cash bonuses is preferred by the Committee.

In December of 2006 and 2007, the Committee granted phantom shares for 2007 and 2008 to each of the Named Executive Officers. Phantom shares were granted to the Named Executive Officers concerning unexercised options heldfor 2007 and 2008 as follows:

| | | Phantom Share Grants | |

| Named Executive Officer | | 2007 | | | 2008 | |

| | # of Shares | | | Dollar Value Earned(1) | | | # of Shares | | | Dollar Value Estimate(1) | |

| C.R. Cloutier | | | 125,000 | | | $ | 173,750 | | | | 131,250 | | | $ | 175,875 | |

| J. Eustis Corrigan Jr. | | | 37,500 | | | $ | 52,125 | | | | 39,375 | | | $ | 52,763 | |

| Karen L. Hail | | | 62,500 | | | $ | 86,875 | | | | 65,625 | | | $ | 87,938 | |

| Donald R. Landry | | | 45,000 | | | $ | 62,550 | | | | 47,250 | | | $ | 63,315 | |

| A. Dwight Utz | | | 27,549 | | | $ | 38,293 | | | | 28,926 | | | $ | 38,761 | |

(1) Both earned and estimated amounts based upon a 12/31/2007 basic undiluted EPS value of

December 31, 2004.Option Values As$1.34. The share numbers were adjusted during 2007 to reflect a 5% stock dividend on September 19, 2007. The number of December 31, 2004

| | | | | | | | | | | | | | | | | |

| | | Number of Securities | | Value of Unexercised |

| | | Underlying Unexercised | | In-the-Money Options |

| | | Options at | | At |

| Name | | December 31, 2004 | | December 31, 2004(1) |

| | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

| C. R. Cloutier | | | 53,436 | | | | 10,313 | | | $ | 1,045,172 | | | $ | 180,890 | |

| | | | | | | | | | | | | | | | | |

| Jennifer Fontenot | | | 6,076 | | | | 1,725 | | | $ | 132,496 | | | $ | 15,141 | |

| | | | | | | | | | | | | | | | | |

| Karen L. Hail | | | 34,239 | | | | 4,950 | | | $ | 693,909 | | | $ | 86,823 | |

| | | | | | | | | | | | | | | | | |

| Donald Landry | | | 10,098 | | | | 4,125 | | | $ | 164,186 | | | $ | 72,353 | |

| | | | | | | | | | | | | | | | | |

| A. Dwight Utz | | | 4,400 | | | | 4,475 | | | $ | 82,090 | | | $ | 67,199 | |

(1) | | Reflects the difference between the closing sale price of a share of MidSouth Common Stock on December 31, 2004, and the exercise price of the options. |

Option Exercises

shares for 2007 represents the amount of shares allocated at the beginning of the plan year. The following table contains information with respect2008 numbers reflect the impact of the 5% stock dividend.

• Long Term Equity Awards. Salary and annual incentives tend to reward shorter term goals; however, it is important to focus on long term performance, which is why we have historically granted stock options. A stock option only rewards the executive if our stock price increases over a period of time. Due to the Named Executive Officer concerning options exercised in 2004. | | | | | | |

| | Shares Acquired | | |

Name | | On Exercise | | Value Realized |

C. R. Cloutier | | | 2,500 | | | $56,125(1) |

| | | | | | |

Donald Landry | | | 13,922 | | | $398,726(2) |

(1) | | Reflects the difference between the $27.30 closing pricerestructuring activities of the Common Stock on December 28, 2004, and the respective exercise price of the options.

|

|

(2) | | Reflects the difference between the $34.70 closing price of the Common Stock on March 19, 2004, and the respective exercise price of the options. |

- 12 -

Stock Option Grants

The following table sets forth information concerning the grant ofCompany, the Committee did not award stock options to any of the Named Executive Officers in 2004.

Stock Option Grants2007. All long-term equity award programs will be reviewed during 2008.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Potential Realization | |

| | | | | | | | | | | | | | | | | | | Value of Assumed | |

| | | | | | | % of Total | | | | | | | | | | | Annual Rates of Stock | |

| | | No. of Shares | | | Options to | | | | | | | | | | | Price Appreciation for | |

| | | Underlying | | | Employees | | | Exercise | | | Expiration | | | Option Term | |

| Name | | Options | | | In 2004 | | | Price(1) | | | Date | | | 5% | | | 10% | |

| Jennifer Fontenot | | | 625 | | | | 4.69 | % | | $ | 28.40 | | | Feb. 26, 2014 | | $ | 350 | | | $ | 1,213 | |

| A. Dwight Utz | | | 625 | | | | 4.69 | % | | $ | 28.40 | | | Feb. 26, 2014 | | $ | 350 | | | $ | 1,213 | |

(1) | | The exercise price represents the fair market valueThe Company did make contributions to the ESOP in 2007 on behalf of the MidSouth Common Stock on the date of grant. The options are not exercisable for one year from the date of grant and become exercisable thereafter in 20% increments each year, unless exerciseability is accelerated by the Personnel Committee or upon a change in control of MidSouth. |

Employment and Severance Contracts with Named Executive Officers. It is our belief that executive officers need to have a significant interest tied to long term performance and increasing shareholder value. We believe the best way to accomplish this is through stock ownership of the Company. We encourage executive officers to own stock and provide the following programs to encourage stock ownership. We describe our employee stock ownership plan, our 1997 Stock Incentive Plan, and our 2007 Omnibus Incentive Compensation Plan below.

Employee Stock Ownership Plan: To encourage ownership by all employees and therefore tie their interest to the interests of the shareholders, we established an employee stock ownership plan (“ESOP”) in 1986. The ESOP covers all employees who meet minimum age and service requirements. We make annual contributions to the ESOP in amounts as determined by the Board of Directors.

1997 Stock Incentive Plan: In addition to the ESOP, we have periodically granted stock options to executive officers and other senior employees. Our policy has been to grant stock options to executive officers to ensure that they have options currently outstanding. To the extent that the executive officer has unvested options outstanding, we feel that the executive officer is tied to our long term performance and will only grant additional awards to the extent that all awards are vested. We have historically granted to executive officers stock options that vest 20% per year over a 5 year period. During 2007, this equity-based incentive plan was replaced with the shareholder approved omnibus incentive plan described below.

2007 Omnibus Incentive Plan: In 2007 we received shareholder approval for an Omnibus Incentive Plan.

No equity awards were made under this plan in 2007. This plan provides the Company with flexibility in the design and implementation of long-term equity award programs. Under this plan the Committee may award a variety of forms of equity such as restricted stock, stock appreciation rights, and performance shares. For details on the plan please refer to the Company’s 2007 Proxy filed on May 30, 2007.

Stock option grants always have an exercise price equal to our stock price at the time they are awarded. We never engaged in the back-dating of stock options nor have we retroactively modified our stock option awards.

We grant stock options upon hire of an executive officer, upon exceptional achievement, or to ensure that an executive officer has outstanding unvested options. We did not provide any additional long term compensation under the Stock Incentive Plan in 2007

We believe that stock options are the preferable method of incenting and rewarding long term performance because stock options provide incentive to increase shareholder value and serve as a good retention vehicle for the Named Executive Officers.

• Perquisites. The Company provided the following perquisites in 2007 to certain executive officers:

| | Country club membership; |

| | Health club membership; |

| | Dinner club membership; and |

| | Supplemental long-term disability and life insurance. |

The total cost for all of these perquisites was approximately $38,000. We provide further details on perquisites in a supplementary table following the Summary Compensation Table in this document.

The Named Executive Officers

are all eligible to receive additional perquisites if the Committee so determines. We view certain perquisites as beneficial to us as well as compensation to the executive officers. For example, the club memberships are regularly used in the general course of our business such as for business meetings or entertaining. The Company cars are used primarily for business purposes.

• Retirement Benefits. We do not have a defined benefit pension plan. However, executive officers are eligible to participate in our 401(k) retirement plan, which is a Company-wide, tax-qualified retirement plan. The intent of this plan is to provide all employees with a tax-advantaged savings opportunity for retirement. We sponsor this plan to help employees in all levels of the Company save and accumulate assets for use during their retirement. As required, eligible pay under this plan is capped at Internal Revenue Code (IRC) annual limits. We make annual matching contributions to the 401(k) retirement plan on behalf of the executive officers.

We have entered into Executive Indexed Salary Continuation Agreements with Mr. Cloutier, Ms. Hail, and Mr. Landry. The agreements provide that upon the executive officer reaching normal retirement age the executive officer will receive payment of amounts as defined in the agreement and presented in the narrative of the Nonqualified Deferred Compensation section of this document.

• Health and Insurance Plans. The executive officers are eligible to participate in Company-sponsored benefit plans on the same terms and conditions as those generally provided to salaried employees. Basic health benefits, dental benefits, and similar programs are provided to make certain that access to healthcare and income protection is available to our employees and the employee’s family members. The cost of Company-sponsored benefit plans are negotiated with the providers of such benefits and the executive officers contribute to the cost of the benefits.

The Company maintains a split dollar insurance arrangement with Mr. Cloutier, Ms. Hail and Mr. Landry. The arrangement provides benefits to the executive officer’s designated beneficiary in the event of the executive officer’s death.

Additionally, we provide Mr. Cloutier, Ms. Hail and Mr. Landry with a supplemental Term Life Insurance Policy payable to a beneficiary of their choice and a supplemental long-term disability policy. We provide additional details on the benefits provided under these policies in the Potential Payments Upon Termination or Change in Control section.

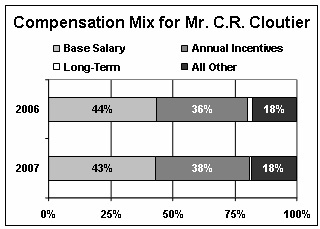

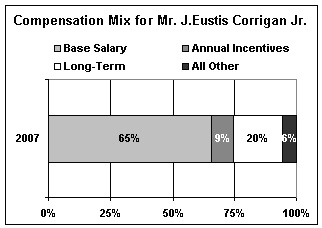

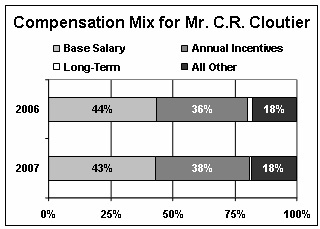

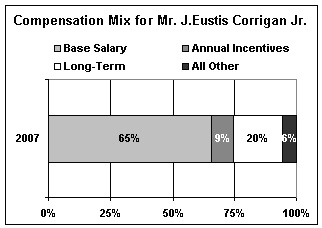

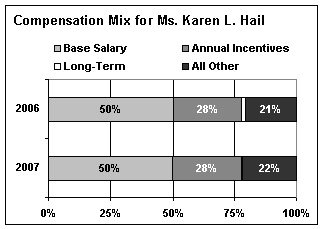

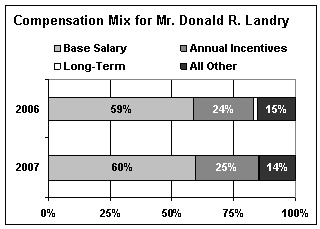

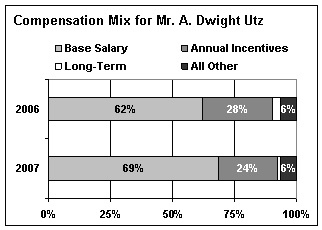

• Compensation Mix. The Company incorporates a significant portion of the NEOs compensation in the form of annual incentives. As noted earlier, the annual incentive plan is tied to earnings per share and provides a strong link between executive compensation and shareholder interests. In addition, when determining compensation levels the Committee takes into consideration all the elements of compensation to arrive at a total compensation amount.

In the figures on the following page, we present the actual pay mix results during 2006 and 2007 for each of our NEOs. Because Mr. Corrigan was hired in mid-2006, we only present his first complete year of employment at the Company.

Other Important Compensation Policies Affecting Executive Officers

• Financial Restatement. Currently, the Committee does not have an official policy governing retroactive modifications to any cash or equity based incentive compensation paid to the executive officers where the payment of such compensation was predicated upon the achievement of specified financial results that were subsequently the subject of a restatement. However, we adhere to Section 304 of the Sarbanes-Oxley Act of 2002 which requires that if a company is forced to restate its financials the company’s Chief Executive Officer and Chief Financial Officer must give back certain incentives based or equity based compensation received.

We have never retroactively modified incentives or equity based compensation for our employees.

The Incentive Compensation Plan pays out quarterly based on our EPS for each quarter; however, only 60% of the value is paid out. The remaining 40% is held back until after year-end earnings have been determined. If there is a decline in earnings for the year, amounts held back may not be paid to the executive officers as the annual incentive is based on our EPS.

• Stock Ownership Requirements. The Committee does not maintain a policy relating to stock ownership guidelines or requirements for our executive officers. The Committee does not believe it is necessary to impose such a policy on the executive officers. Currently, the Named Executive Officers, as a group, hold a substantial portion of the Company’s stock. If circumstances change, the Committee will review whether such a policy is appropriate for its executive officers.

• Trading in the Company’s Stock Derivatives. The Committee does not have a writtenpolicy prohibiting executive officers from purchasing or selling options on our stock, engaging in short sales with respect to our stock, or trading in puts, calls, straddles, equity swaps or other derivative securities that are directly linked to our stock. We are not aware that any of the executive officers have entered into these types of arrangements.

• Tax Deductibility of the Named Executive Officers’ Incentive and Equity Compensation. Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public companies for compensation over $1.0 million paid to a corporation’s Chief Executive Officer and the four other most highly compensated executive officers.

In connection with the compensation of our executive officers, the Committee is aware of section 162(m) as it relates to deductibility of qualifying compensation paid to executive officers. The Committee believes that compensation to be paid in 2007 will not exceed the deductibility limitations on non-excluded compensation to certain executive officers.

• Employment Agreements. We have entered into employment agreements with our Chief Executive Officer, Chief Operating Officer, and Chief Financial Officer. We will enter into a new employment agreement with an executive officer or a potential candidate only when it is essential to attract or retain an exceptional employee. Any employment agreement with an executive officer must be approved by the Bank forBoard of Directors and should have as short a term as possible and provide as few terms and conditions as are necessary to accomplish its purpose.

All of one year, beginning January 1stthe employment agreements have trigger events that provide for the payment of severance to the executive officer upon certain termination events. We have included these trigger events in the employment agreements to provide a safe harbor so that the executive officer can provide services to us without being concerned about his/her employment.

We do not maintain a separate severance plan for our executive officers. Severance benefits for our executive officers are limited to those as set forth in the respective executive officer’s employment agreement with us.

Set forth below are the general terms and conditions of each year. The agreements areof the employment agreements. Each executive has the right to voluntarily terminate his/her employment at any time.

___________________

General

C.R. Cloutier - Chief Executive Officer

Karen L. Hail - Chief Operating Officer

Each employment agreement is a one-year written agreement and is automatically extended for one year every year thereafter, beginning on the termination date, unless written notice of termination is given by any party to the agreement not later than 60 days before the termination date. Pursuant toend of the contract,year. Under Mr. Cloutier,Cloutier's and Ms. Hail and Mr. LandryHail's agreement, each of them receive a minimum annual base salary, term life insurance equal toin the amount of four times their annual base salary payable to a beneficiary of theirhis or her choice, and disability insurance of not less than two-thirds of their annual salary.base salary, an automobile furnished by the Company (including insurance, gasoline, and other routine maintenance), membership at a health club, and membership at a dinner club.

In the event that we terminate Mr. Cloutier’s

or Ms.

Hail’s and Mr. Landry’s contracts have a severance provision which entitles them to one year’s salary ifHail's employment or do not extend the agreement,

is terminated byeach will be entitled to severance pay equal to annual base salary at the

Bank, unless they aretime of termination. We will not be obligated to pay any severance pay in the event that he or she terminates voluntarily or is removed by a regulatory body.

Certain Transactions

Upon a change in control of the Company, Mr. Cloutier or Ms. Hail each has the right to resign employment for Good Reason and receive as severance pay a sum equal to annual base salary immediately prior to the change in control, payable in twelve equal installments. Good Reason is deemed to occur upon one of the following events:

| (1) | a reduction in the salary or benefits of the executive officer in effect before the effective date of the change in control or within two years after the effective date of the change in control; |

| (2) | a requirement that executive officer move his residence out of Lafayette, Louisiana; |

| (3) | a requirement that executive officer engage in excessive business travel (i.e., travel of more than 75 miles from Lafayette, Louisiana for more than an average of seven business days per month) as part of his job duties; or |

| (4) | the executive officer’s office is moved outside of the Lafayette MSA. |

None of the executive officers is entitled to receive a Gross-Up payment in the event that he or she is subject to section 280G excise tax pursuant to a change in control of the Company.

J. Eustis Corrigan, Jr. - Chief Financial Officer

Mr. Corrigan’s employment agreement provides that he will receive a minimum annual base salary and is eligible to receive all standard benefits provided by us to other employees in positions comparable to his position. We are required to reimburse him for his COBRA premiums being paid in connection with his separation of employment from his previous employer until the date that he becomes eligible to participate in our group health insurance programs. In addition, Mr. Corrigan received an initial grant of 30,000 phantom shares under the Incentive Compensation Plan and 15,000 stock options under our Stock Incentive Plan. These amounts have been adjusted accordingly for the 5:4 stock split on October 24, 2006, and the 5% stock dividend on September 19, 2007. We are required to provide him with either a health club membership or a country club membership. The agreement also provides for the reimbursement of moving expenses incurred by Mr. Corrigan in moving from Texas to Lafayette and a signing bonus of $10,000. Both the moving expense reimbursement and signing bonus are earned over a three-year period beginning upon date of hire.